The U.A.E. has several price indexes that track prices for goods and services within the country. The Consumer Price Index (C.P.I.) is the most commonly used index, which measures price changes for a basket of goods and services typically purchased by consumers. Other vital indexes include the Producer Price Index (PPI), which measures changes in prices received by producers for their output, and the Gross Domestic Product (G.D.P.) deflator, which measures changes in prices for all goods and services produced within the U.A.E.

This post will initially provide a comprehensive overview of the C.P.I., its definition, importance, and measurement method. Finally, give you an insight into C.P.I.’s statistics for the U.A.E.’s market.

Table of Contents

Definition of Consumer Price Index

A consumer price index (C.P.I.) measures the cost of a market basket of products and services for consumers that households purchase on average and are weighted. Changes in the C.P.I track price fluctuations throughout time.

To clarify, a C.P.I. is a statistical calculation created using a sample of typical products with frequently gathered prices. Sub-indices and sub-sub-indices can be calculated for various categories and sub-categories of goods and services. These sub-indices and sub-sub-indices are then combined to produce the overall index, with weights reflecting their shares in the total consumer expenditures covered by the index.

Consumer price index reflects changes in the cost to the average consumer of acquiring a basket of goods and services that may be fixed or changed at specified intervals, such as yearly.

KNOEMA

It is one of many price indices that are computed by the majority of national statistics organizations. A C.P.I.’s yearly percentage change is utilized to gauge inflation. A CPI can control prices, deflate monetary magnitudes to reflect changes in actual values, and index (i.e., compensate for the effect of inflation) the real worth of wages, salaries, and pensions.

The C.P.I. is one of the most carefully followed national economic data in most countries, along with the population census.

The Importance of the Consumer Price Index

The Consumer Price Index (C.P.I.) is a commonly used metric to assess inflation in an economy. The standard of living for a country’s citizens declines due to rising inflation. It will eventually lead to a rise in the cost of living. A high rate of inflation will raise the cost of goods and, as a result, reduce production, leading to job losses.

Uses of the Consumer Price Index

- Serving as an economic indicator: The Consumer Price Index is a gauge of consumer price inflation. It can affect the dollar’s buying power. It also serves as a stand-in for a government’s economic policy’s efficacy.

- To account for price variations in other economic indicators: For instance, the C.P.I. might be used to alter several aspects of the national income.

- To provide adjustments to the cost of living: C.P.I. can help wage earners and social security recipients to adjust their cost of living and keeps tax rates from rising as a result of inflation.

Measurement Issues with the C.P.I.

- Sampling Error: It refers to the possibility that the incorrect sample was selected. The representative may not accurately represent the population as a whole.

- Non-Sampling Errors: These mistakes might occur during the acquisition of pricing data or during the implementation of operations.

- Not Including Energy Costs: Despite being a significant expense for most households, energy prices are not included in the C.P.I., which has drawn considerable criticism.

C.P.I. Measurement

The Consumer Price Index, or C.P.I., compares current prices to those that prevailed at the same time last year to determine how much prices have changed for a typical basket of goods and services.

The C.P.I. calculation formula is:

C.P.I. = (Cost of the market basket in a given year / Cost of the market basket in the base year) x 100

Consumer Price Index for U.A.E.

The C.P.I. in the U.A.E. rose by 2.0% in 2015 after increasing by 1.6% in 2014. The main drivers of inflation were higher prices for housing, water, and electricity; transportation; and food and beverages.

The C.P.I. of the United Arab Emirates fell by 2.08 %, from 114.5 in 2019 to 112.1 in 2020. Since the 3.07 % upward trend in 2018, the C.P.I. slipped by 3.97 % in 2020.

| Actual | Previous | Highest | Lowest | Dates | Unit | Frequency | Base Year |

| 108.62 | 108.60 | 112.29 | 89.17 | 2008-2021 | Points | Monthly | 2014=100, N.S.A. |

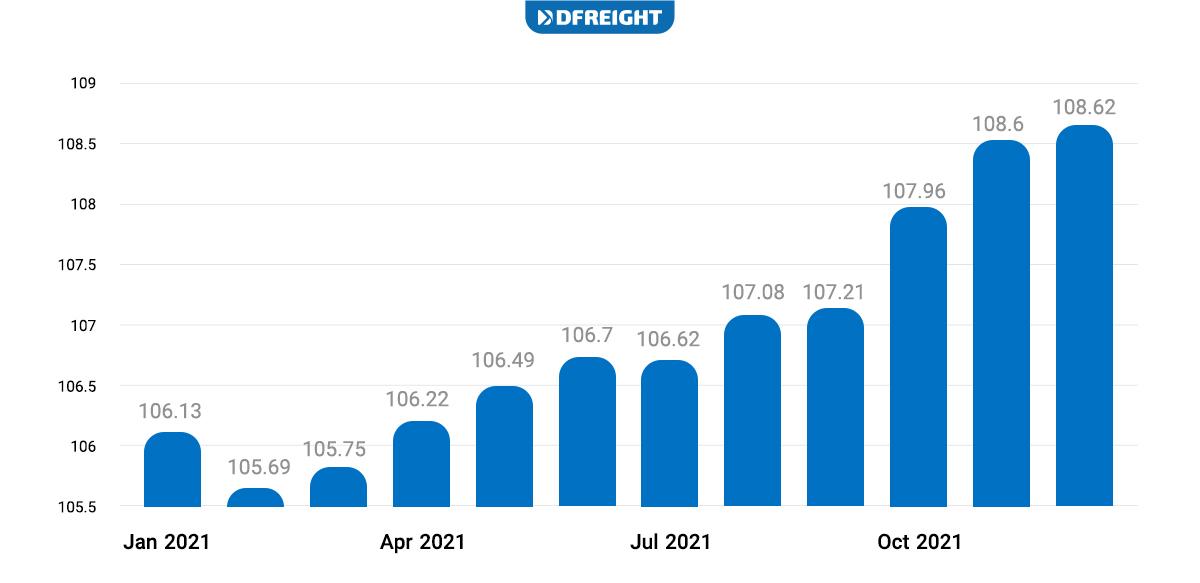

According to the U.A.E. government, the Consumer Price Index (C.P.I.) for the U.A.E. is expected to rise by around 2.5% in 2022. This is based on the assumption that there will be no significant changes in the country’s inflation rate or economic growth. The cost of living in the U.A.E. is expected to rise moderately over the next few years. Based on government data, the U.A.E.’s Consumer Price Index increased 2.5% in 2021, rising to 108.62 points by the end of the year from 105.97 points in December 2020.

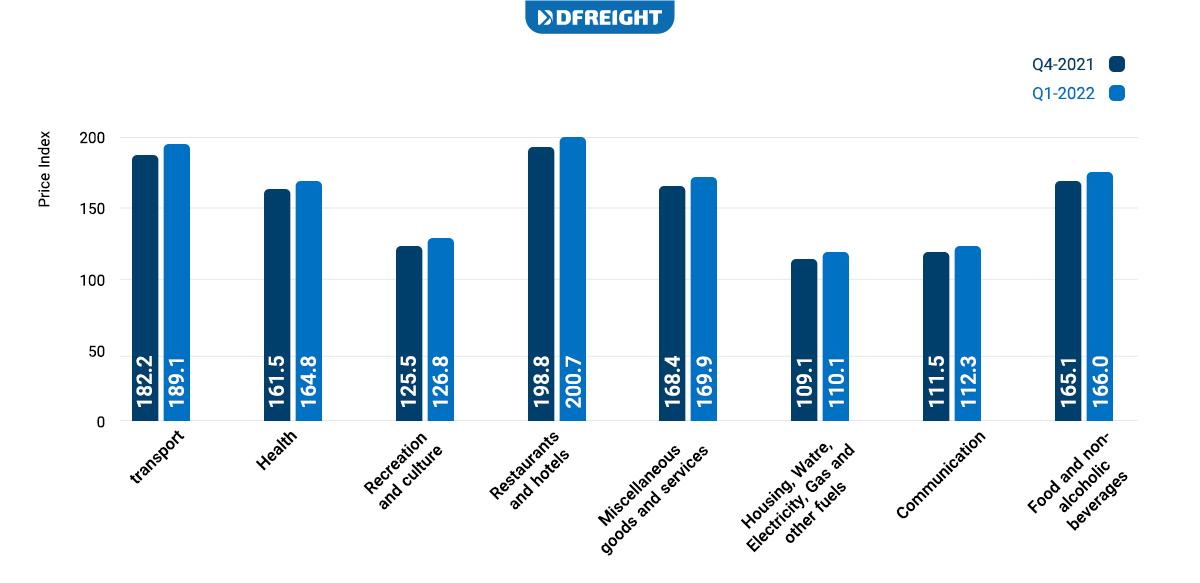

| Items | Q4-2021 | Q1-2022 | Inflation Rate (%) |

| Actual Rentals for Housing | 103.4 | 104.0 | 0.6 |

| Actual rentals paid by tenants | 103.4 | 104.0 | 0.6 |

| Maintenance and Repair of the Dwelling | 161.0 | 165.7 | 2.9 |

| Materials for the maintenance and repair of the dwelling | 161.4 | 168.5 | 4.4 |

| Services for the maintenance and repair of the dwelling | 160.1 | 160.1 | 0.0 |

| Water Supply & Miscellaneous Services Relating to the Dwelling | 100.0 | 100.0 | 0.0 |

| Water supply | 100.0 | 100.0 | 0.0 |

| Electricity, Gas & Other Fuels | 126.5 | 128.4 | 1.5 |

| Electricity | 116.0 | 116.0 | 0.0 |

| Gas | 188.1 | 201.2 | 7.0 |

| Other files (liquid/dried) | 126.9 | 128.0 | 0.9 |

| Items | Q4-2021 | Q1-2022 | Inflation Rate (%) |

| Purchase of Vehicles | 142.0 | 140.8 | -0.9 |

| Motor cars | 141.6 | 140.2 | -1.0 |

| Motorcycles | 154.9 | 161.2 | 4.1 |

| Operation of Personal Transport Equipment | 215.0 | 248.3 | 15.5 |

| Spare parts and accessories for personal transport equipment | 159.5 | 157.6 | -1.2 |

| Fuels and lubricants for personal transport equipment | 235.4 | 288.3 | 22.4 |

| Maintenance and repair of personal transport equipment | 213.2 | 219.2 | 2.8 |

| Other services in respect of personal transport equipment | 157.3 | 157.7 | 0.3 |

| Transport Services | 184.9 | 179.8 | -2.7 |

| Passenger transport by road | 198.7 | 198.7 | 0.0 |

| Passenger transport by air | 174.5 | 165.9 | -4.9 |

| Other purchased transport services | 205.0 | 206.5 | 0.8 |

| Items | Q4-2021 | Q1-2022 | Inflation Rate (%) |

| Personal Care | 132.5 | 133.9 | 1.1 |

| Hairdressing salons and personal grooming establishments | 156.8 | 157.3 | 0.3 |

| Electric appliances for personal care | 120.1 | 118.7 | -1.2 |

| Other appliances, articles, and products for personal care | 128.2 | 129.8 | 1.3 |

| Personal Effects N.E.C. | 307.4 | 310.4 | 1.0 |

| Jewelry, clocks, and watches | 336.4 | 339.9 | 1.0 |

| Other personal effects | 150.6 | 151.0 | 0.3 |

| Insurance | 69.6 | 69.6 | 0.1 |

| Insurance connected with transport | 69.6 | 69.6 | 0.1 |

| Financial Services N.E.C. | 86.9 | 86.9 | 0.0 |

| Other financial services N.E.C. | 86.9 | 86.9 | 0.0 |

| Other Services N.E.C. | 106.0 | 106.0 | 0.0 |

| Fees for official certificates (resident renewal, birth cert., etc.) | 104.4 | 104.4 | 0.0 |

| Other services (duplicating/newspaper notices, etc.) | 153.2 | 153.2 | 0.0 |

F.A.Q.s

What does C.P.I. stand for?

C.P.I. stands for “Consumer Price Index.”

What is Consumer Price Index (C.P.I.)?

The Consumer Price Index (C.P.I.) calculates and tracks the overall change in consumer prices over time, depending on a sample basket of products and services.

How is C.P.I. measured?

The C.P.I. calculation formula is: C.P.I. = (Cost of the market basket in a given year / Cost of the market basket in the base year) x 100

What is C.P.I. for the U.A.E. in 2022?

The Consumer Price Index (C.P.I.) for the U.A.E. is expected to increase by nearly 2.5% in 2022. It rose to 108.62 points by the end of 2021.

How is C.P.I. used?

Markets and policymakers pay great attention to the C.P.I. as an indicator of inflation. A CPI measure calculates cost-of-living adjustments (COLAs) for federal benefit payments.

What is the difference between C.P.I. and inflation?

In general, inflation increases the cost of products and services. The Consumer Price Index is a gauge of inflation as experienced by ordinary people in their daily life. The Consumer Price Index is the most widely-used technique for measuring inflation.